Budget LCD, Lower-Priced Plasma HDTV Sales Soar

August 17, 2009

By Erik Gruenwedel

Home Media Magazine

Sales of lower-priced plasma high definition televisions and smaller screen size LCD units surged in the second quarter, underscoring continued weakness at the retail level, according to new data from Quixel Research.

Portland, Ore.-based Quixel said plasma TV sales increased 31% in volume and 35% in revenue compared to the first quarter, nearly topping the $1 billion threshold at $910 million.

“Unit sales of 42-inch 720p plasma TVs were up 40% quarter-to-quarter as consumers were looking for value in uncertain economic times,” said Tamaryn Pratt, principal at Quixel.

She said sales benefited from the fact the HDTV models came from recognized national brands, which Pratt said backed up the competitive prices.

Overall, plasma revenues remained flat at $3.1 billion from the first quarter, but down 9% compared to the same period last year.

Underscoring the price reductions in plasma, volume sales actually increased 5% quarter-over-quarter and 10% compared to last year’s period.

Unit sales of LCD TVs priced under $500 for 22-inch, 32-inch and 42-inch models increased in the second quarter compared to the first, pushing overall LCD unit sales up 9% in the time period and up 22% from second-quarter 2008. Meanwhile, larger screen size TVs declined 7% in units and 9% in revenue in the second quarter compared to the first.

“In [our] best sellers list, all the models had [selling prices] under $500, but just six months ago we had best sellers with $1,000 selling prices,” Pratt said.

The reduced number of large-screen sales and fast-falling prices drove overall quarterly revenue for the LCD TV category down 2%, with revenues falling to $5.1 billion in the second quarter compared to $5.2 billion in the first. Second quarter sales for the segment fell 8%, compared to the same quarter the previous year.

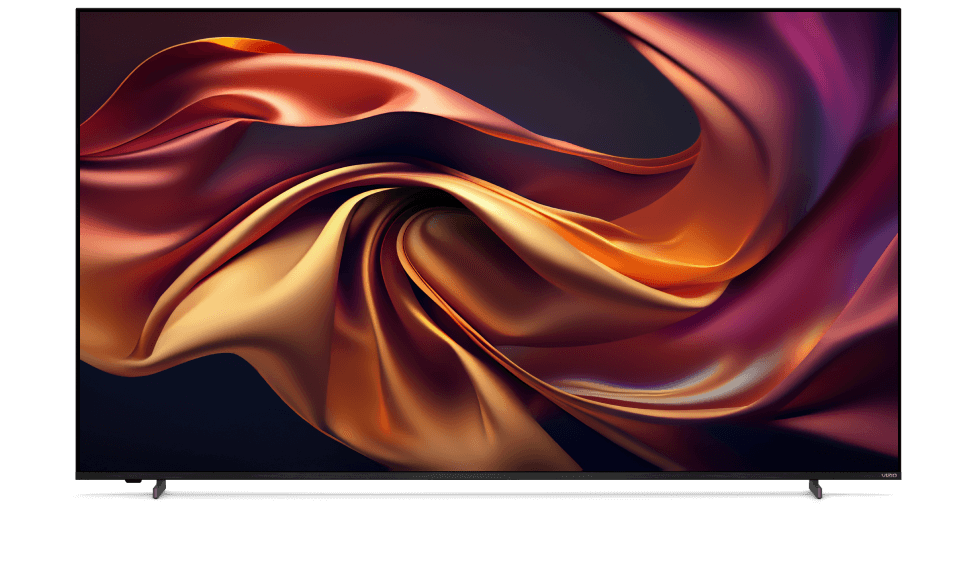

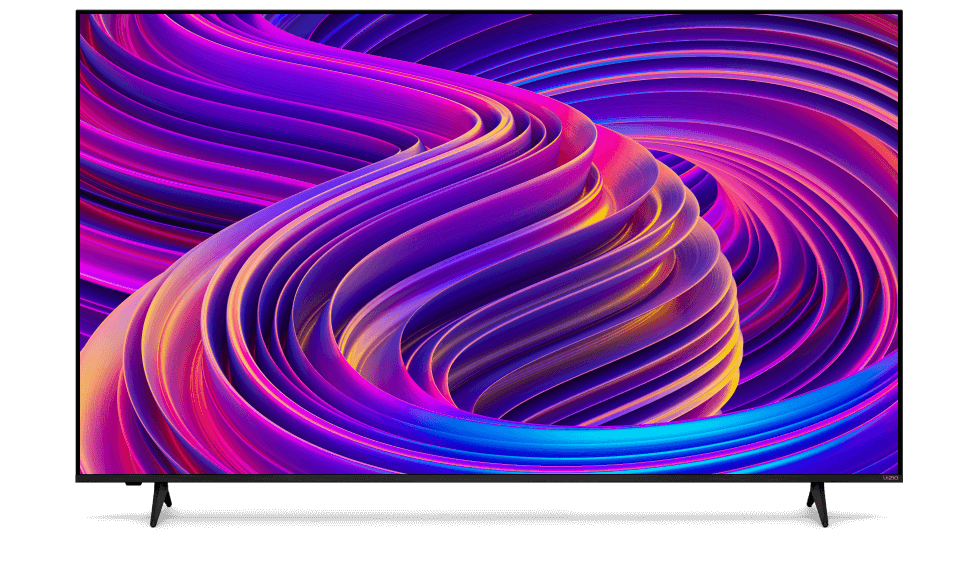

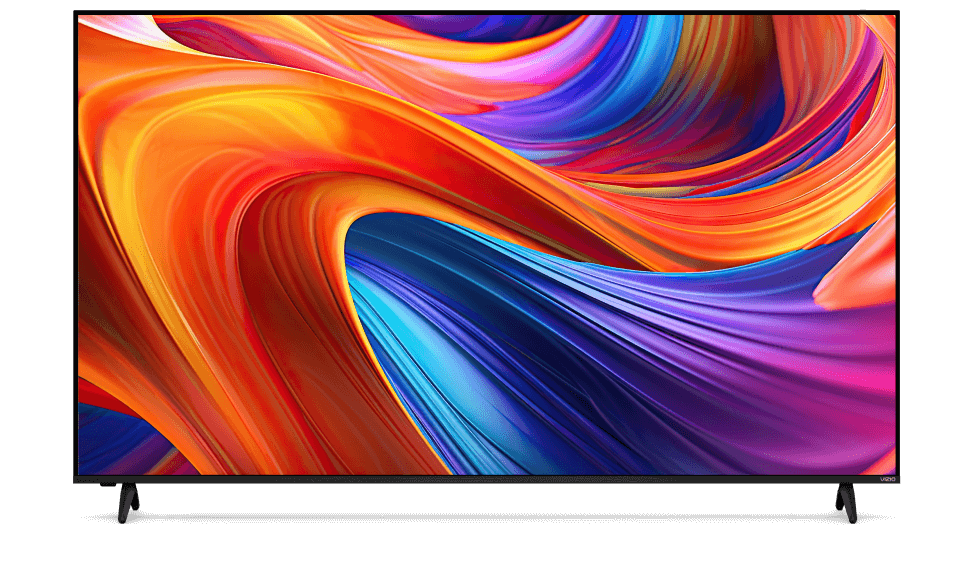

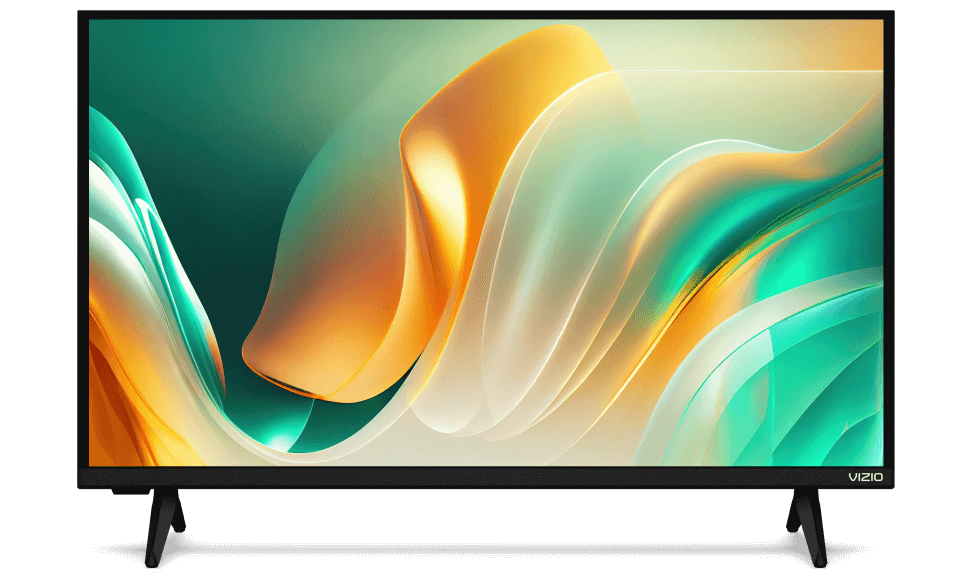

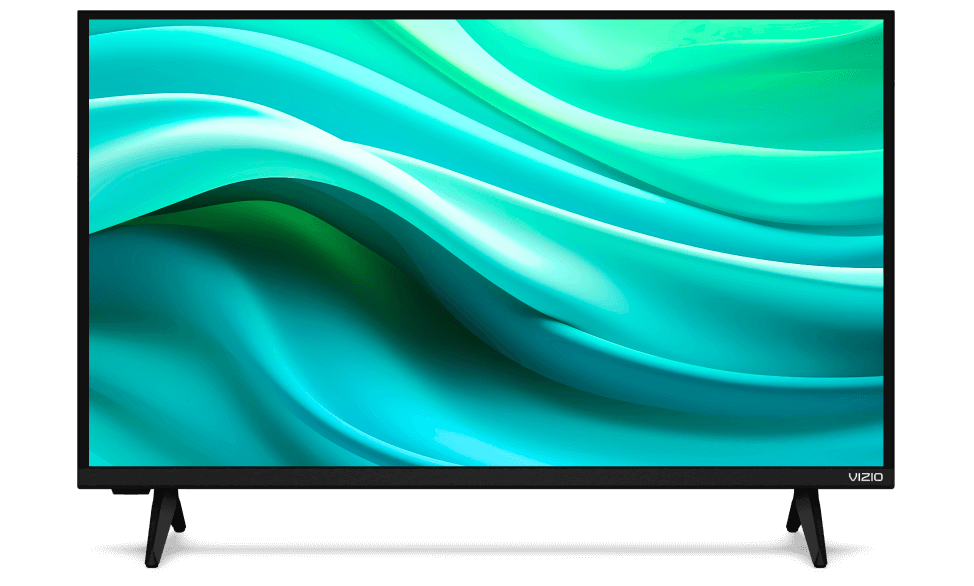

Separately, LCD TV manufacturer Samsung significantly narrowed the gap in the second quarter between Samsung and market leader Vizio due in large part to aggressive marketing of LED-backlit LCD TVs.

South Korea-based Samsung’s LCD TV unit shipments increased to 21.3% in the period, up from 17.8% in the first quarter, while Vizio unit shipments increased just 0.3% to 21.7% from 21.4% in the first quarter.

“U.S. consumers increasingly are warming up to higher-specification LCD-TV models, including those using new LED-backlighting technology,” said Riddhi Patel, principal analyst with iSuppli Corp.

Patel estimates that 2.2% of LCD TVs shipped in the United States in the second quarter used LED backlights, compared to 0% during the same period last year.

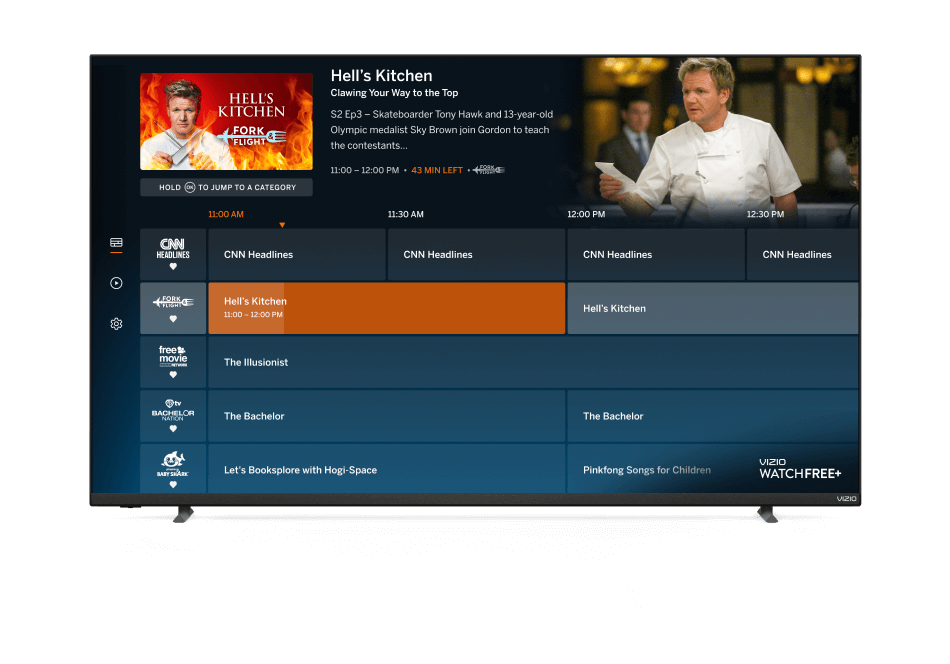

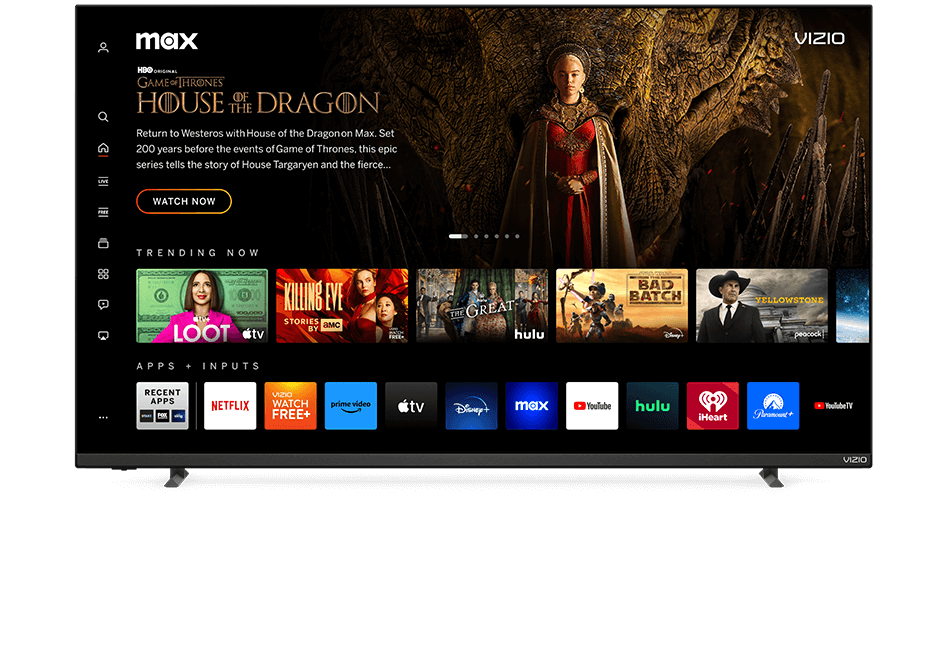

Regardless, the analyst said Vizio continues to prosper marketing lower-cost full-feature HDTVs in high volume retail channels such as Wal-Mart and Costco.

“The company seems to have found the right balance between price and features that appeals to many consumers,” Patel said.

It also remains under scrutiny by regulators.

Last month a Washington, D.C. federal appeals court upheld patent infringement claims brought by Japanese consumer electronics firm Funai Electric Co. Ltd. against various digital high-definition television manufacturers, including Vizio.

The ruling mandates that future HDTVs sold under the Vizio, AOC, Olevia and Envision brands be banned from import or sale in the United States. Product currently in stock at retailers such as Costco, Best Buy and Wal-Mart can still be sold.

http://www.homemediamagazine.com/hdtv/budget-lcd-lower-priced-plasma-hdtv-sales-soar-16755